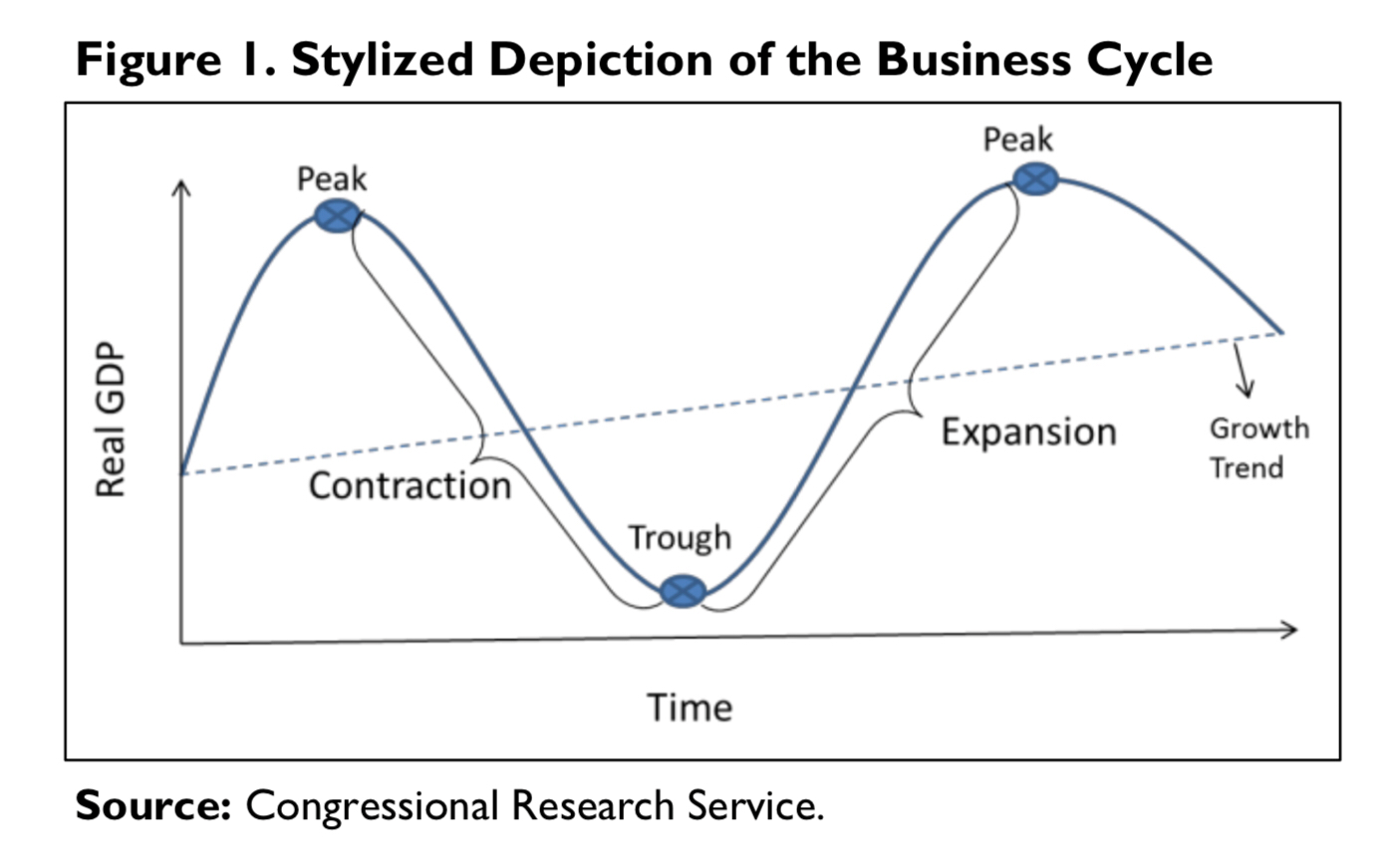

Over time, modern industrial economies tend to experience significant variations in economic activity. The economy shifts from periods of increasing economic activity, known as economic expansions, to periods of decreasing economic activity, known as recessions. Real gross domestic product (GDP)—total economic output adjusted for inflation—is the broadest measure of economic activity. The movement of the economy through these alternating periods of growth and contraction is known as the business cycle.

Using the current economic data, it is easy to identify that we are in the expansion phase of the business cycle. The current debate is not which phase we are in but where we are in the expansion. To find the answer we must first look at historical business cycles. The length of expansion periods has constantly increased since the 1990s and some economists even wondered if this would lead to the end of the business cycle as we knew it. In 2007, hopes of a (mostly) continuous expansion were crushed as the US fell into the deepest recession since the Great Depression.

This recession became known as the Great Recession, and it proved the business cycle was alive and well, but this doesn’t mean expansions are not changing. Expansions are getting longer, and our current expansion will be the 3rd longest in US history by March. In addition to being a long expansion, our current expansion is much slower than usual. Since 2009, we have seen an average GDP growth of only 2.1% while previous expansions saw growth closer to 3%. Slow growth has made this economy very stable and kept inflation at bay, but it has also left investors feeling less than thrilled about their returns.

A long, slow expansion has not only been hard on investors, it has also made it difficult to pin point exactly where the US is in the current expansion. The main question is whether we are in the mid or late expansion phase. In other words, are we going to see continued growth or are we heading into the next recession? To answer this question, we must look at four key economic indicators: employment, personal income, industrial production, and sales.

Conclusion

Determining where an economy is in the business cycle is difficult and timing the business cycle is even harder. Because our economy has been growing slowly through the entire expansion, many investors don’t feel like the economy is in as good of shape as it is. It is tempting to try and time the market to seek higher returns. The long slow growth has made it hard to forecast market trends, but it isn’t all bad. Slow growth is keeping the economy from overheating and it is very likely to see continued growth. However, this does not mean we should make the same mistake and believe recessions are over. The business cycle is alive and well and we expect to see more periods of recession and expansion.

Ahmad Al Shamsi